$36k fees for managing estate a ‘farce’

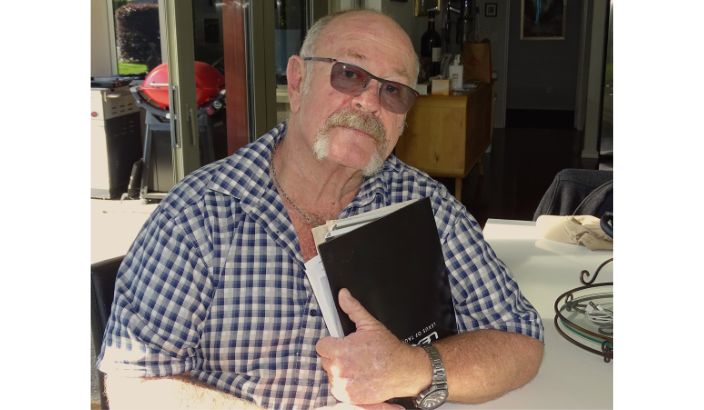

Steve Page says Public Trust’s fee is a “farce”. Photo: Supplied.

When Steve Page’s mother died last year, the family sold her house and he says it should have been a simple process, yet Public Trust still charged $41,000 for managing her estate.

Steve, who is a co-owner of Waimea Weekly, says Public Trust’s fee is a “farce”.

He says it charged $10,000 for “clipping the ticket” for the sale of the house, even when the family had done most of the work to sell it. When one of the grandkids sent several texts to Public Trust about money that their grandmother had intended for the grandkids, their enquiry added $2,000 to the costs.

“It’s a croc, a scam. You aren’t after anything for free – you just want a reasonable deal.”

He was the executor of his mother’s will and says he has been told by one local lawyer that his mother’s estate would have cost between $10,000 and $12,000 in total if it was dealt with through a lawyer.

Steve’s experience with Public Trust got off to a bad start when it emailed him about the death of his wife, rather than mother, and it went downhill as charges mounted.

He says the public need to know about the cost of getting Public Trust to administer their estate when they die.

“They’ve taken their money out by the time the estate hands out dividends to the family.”

Public Trust’s final charge for the family was $36,000 as it has a maximum charge of 5 per cent of the estate, but he says that is still excessive and if his mother’s estate had more value, it would have charged the full $41,000.

Steve says Public Trust wanted a $2,200 health and safety paper for the sale of the house and attempted to enlist an Australian company to value the house at a cost of about $2,000, when it had already been valued by a local agent.

When he complained about costs getting out of control and wanted to see the breakdown of those costs, he was told it was a “modular cost system” which he says is probably used to hide overcharging. He says many of the people using Public Trust are elderly and he suspects they believe it is Government-run and so therefore trust it to administer their estate when they die and may even think it is free.

Public Trust was a government department for 125 years but became an autonomous and self-funding Crown entity in 2002. It is now one of the country’s largest charitable trust administrators and advisors.

In a statement, a Public Trust spokesperson said estate administration involves legal, property, financial and tax matters, as well as family dynamics, so it can get complicated. Each estate is unique, and the cost depends on the services people need and the time it takes.

“We are sorry Mr Page is unhappy about how elements of his late mother’s estate were handled. In this case, there were complexities to work through, involving not just Mr Page but others provided for in the will. We consider the fees charged were fair and reasonable.

“Public Trust has engaged constructively, answering Mr Page’s questions and providing a detailed breakdown of all fees and charges. While he didn’t take up our offer for a meeting to discuss his concerns, we have suggested he talks to the financial services ombudsman for an independent view – that option remains open to him.”

Steve says the estate was not complex though and many of his emails were ignored.

“There were no tricky legal or moral parts to the will. The Public Trust is not telling the truth here. A single woman with modest bank savings and ownership of a family home was the sum of the estate. And contrary to Public Trusts comments, there were only two sibling beneficiaries.”

He scoffs at Public Trust’s suggestion of talking with the ombudsman and did not take up the offer of a meeting because he says it is slick at explaining its costs and has never been admonished by the ombudsman to date.

He says individuals cannot afford to fight Public Trust about costs and it would take a class action to make changes.

His mother had dementia at the end of her life and Steve says her death was not a surprise, whereas many people losing someone would not be in a good emotional space to stand up against Public Trust.

In its response, Public Trust says that at a time when many household budgets are stretched, it is committed to providing affordable and accessible services.

“We are upfront about the costs involved and promote price transparency by publishing our fees and charges online for anyone to see. It is important people choose the service provider that’s right for them. People want peace of mind that their wishes will be carried out efficiently and objectively.”